All Categories

Featured

Table of Contents

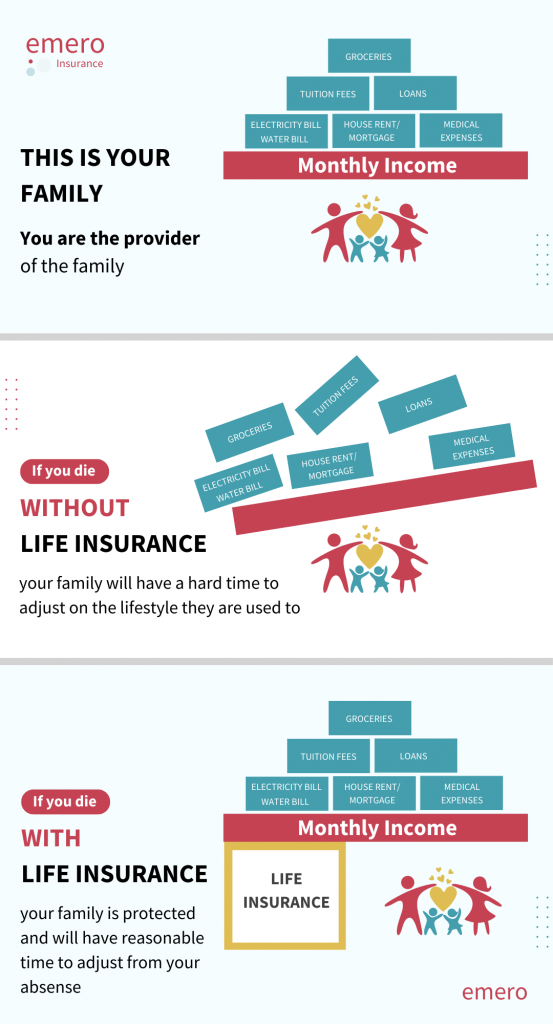

Home mortgage life insurance policy supplies near-universal coverage with minimal underwriting. There is commonly no medical exam or blood sample required and can be a beneficial insurance coverage alternative for any kind of property owner with serious preexisting medical conditions which, would certainly stop them from purchasing traditional life insurance policy. Various other advantages include: With a home mortgage life insurance coverage plan in place, heirs won't need to fret or wonder what could happen to the household home.

With the mortgage repaid, the family members will constantly have a location to live, supplied they can manage the real estate tax and insurance every year. home loan property insurance.

There are a couple of different kinds of home mortgage protection insurance coverage, these include:: as you pay even more off your mortgage, the quantity that the policy covers reduces in line with the exceptional equilibrium of your home mortgage. It is one of the most typical and the most affordable kind of home loan protection - mms mortgage protection.: the amount guaranteed and the costs you pay continues to be degree

This will certainly repay the home loan and any kind of staying balance will go to your estate.: if you desire to, you can add serious illness cover to your home mortgage defense plan. This suggests your mortgage will be removed not just if you die, however also if you are detected with a major disease that is covered by your policy.

Insurance And Mortgage Services

Additionally, if there is an equilibrium remaining after the home loan is cleared, this will certainly most likely to your estate. If you change your home loan, there are numerous points to think about, depending on whether you are covering up or expanding your mortgage, changing, or paying the home loan off early. If you are topping up your home loan, you need to make sure that your plan fulfills the brand-new worth of your mortgage.

Contrast the expenses and advantages of both alternatives (mortgage insurance layoff protection). It might be more affordable to keep your original mortgage security policy and then buy a 2nd plan for the top-up quantity. Whether you are topping up your home mortgage or expanding the term and need to obtain a new plan, you may discover that your premium is greater than the last time you got cover

Mortgage Insurance Payment

When changing your mortgage, you can appoint your home loan protection to the new loan provider. The costs and degree of cover will coincide as prior to if the quantity you obtain, and the regard to your home mortgage does not transform. If you have a plan with your loan provider's group scheme, your lender will terminate the plan when you change your home loan.

There won't be an emergency situation where a large bill is due and no other way to pay it so not long after the fatality of a liked one. You're supplying assurance for your family members! In The golden state, mortgage defense insurance policy covers the entire outstanding balance of your car loan. The survivor benefit is an amount equivalent to the equilibrium of your mortgage at the time of your death.

Mortgage Insurance Plan

It's important to comprehend that the survivor benefit is provided straight to your creditor, not your loved ones. This assures that the continuing to be financial debt is paid completely which your liked ones are saved the economic pressure. Home loan protection insurance can additionally give momentary coverage if you become disabled for a prolonged duration (normally 6 months to a year).

There are lots of benefits to obtaining a mortgage defense insurance plan in The golden state. Several of the leading advantages include: Ensured approval: Even if you remain in inadequate health and wellness or operate in a harmful profession, there is ensured approval without medical examinations or lab tests. The very same isn't true forever insurance policy.

Impairment security: As mentioned above, some MPI plans make a couple of home mortgage payments if you become disabled and can not generate the exact same revenue you were accustomed to. It is very important to note that MPI, PMI, and MIP are all various kinds of insurance policy. Home mortgage protection insurance coverage (MPI) is designed to settle a mortgage in instance of your death.

What Is Loan Insurance

You can also use online in minutes and have your plan in location within the same day. For additional information about getting MPI protection for your home lending, call Pronto Insurance today! Our educated agents are here to answer any kind of inquiries you may have and supply additional aid.

MPI provides numerous advantages, such as tranquility of mind and streamlined certification processes. The fatality advantage is straight paid to the lender, which limits flexibility - home protection insurance scheme. Furthermore, the advantage amount decreases over time, and MPI can be extra costly than common term life insurance policy plans.

Mortgage And Income Protection Insurance

Enter basic info regarding on your own and your mortgage, and we'll compare rates from different insurance firms. We'll also show you just how much coverage you require to safeguard your home mortgage.

The main benefit right here is quality and confidence in your decision, recognizing you have a plan that fits your needs. When you authorize the strategy, we'll handle all the paperwork and arrangement, making certain a smooth execution process. The positive result is the assurance that comes with recognizing your family is protected and your home is secure, no issue what takes place.

Professional Advice: Guidance from experienced experts in insurance and annuities. Hassle-Free Setup: We take care of all the documents and implementation. Economical Solutions: Locating the best insurance coverage at the cheapest feasible cost.: MPI specifically covers your home mortgage, giving an added layer of protection.: We work to locate the most cost-efficient solutions tailored to your budget plan.

They can offer details on the coverage and benefits that you have. On average, a healthy person can expect to pay around $50 to $100 each month for home mortgage life insurance coverage. It's recommended to get a tailored mortgage life insurance coverage quote to obtain an exact quote based on private circumstances.

Latest Posts

Senior Burial Insurance Program

United Final Expense Services Reviews

Final Expense Insurance License